Volume 47 No. 7 ● September 1, 2022 ● Member Sneak Peek

You, as Business Manager of your PK–12 school, are in the initial stages of putting together the first draft of your operating budget for the coming year, which will be Year Three of your current strategic financial plan. Line 1A of your strategic financial spreadsheet (not shown in this article) for Year Three displays an enrollment figure of 805. This was the actual enrollment the year before the strategic financial plan was developed and was, and is, regarded as the “ideal” enrollment figure. Line 2, Year Three, of the spreadsheet—Net Tuition Income—shows a figure of $14,490,000 (an average net tuition of $18,000).

Since your School Head and Board leaders have adopted ISM’s often-repeated admonition to “manage to Line 6”—Hard Income P&L—of the strategic financial spreadsheet, you know projecting a figure on Line 1A that is as precise as possible makes related decisions easier. With an accurate enrollment projection, you can recommend with more confidence the figures for listed (published) tuition and for overall tuition assistance, i.e., Enrollment x Listed (published) Tuition = Gross Tuition Income, less Tuition Assistance (discounts in all categories) = Net Tuition Income. Consider the following approach to be a conservatively workable method for projecting the coming year’s enrollment figure.

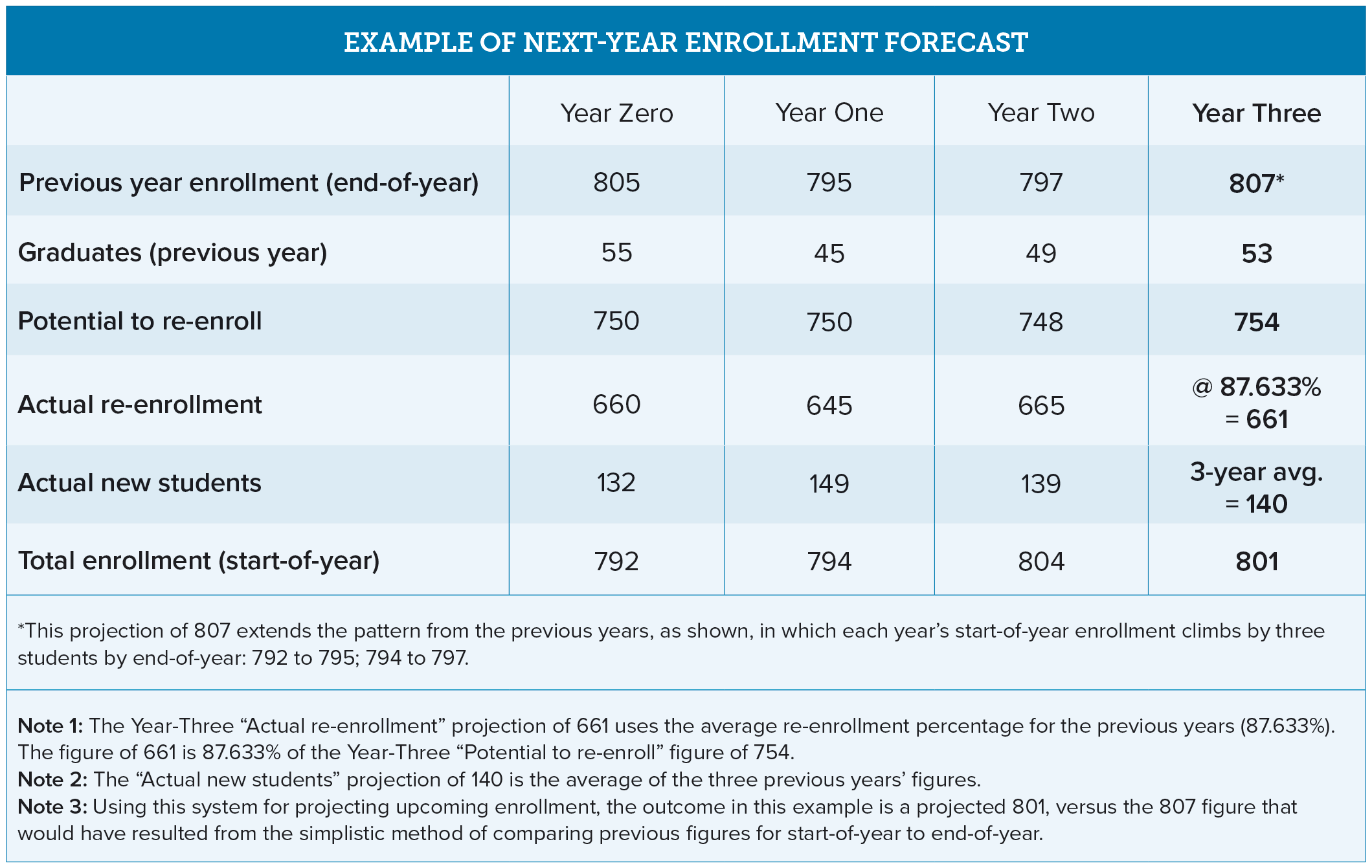

First, assemble your actual figures for the past three years (including the current year) for the:

- total enrollment (end-of-year and start-of-year);

- graduating class total;

- actual number re-enrolled; and

- actual number of new students.

In the following example, Year Zero is the year in which the current strategic financial plan was crafted, Year Two is the current year, and Year Three is the upcoming school year for which you are developing the operating budget.

As noted in this article’s opening paragraph, the strategic financial spreadsheet (not shown in this article) shows a figure of 805 on Line 1A for the upcoming year, which is Year Three of the plan. Had you used the simplest method of projecting the coming year’s enrollment—see Note 3 of the chart—then you would project a figure slightly higher than that used in the strategic financial plan: 807, versus the 805 of the plan’s spreadsheet. Using the method recommended in this article, you will project a figure of 801, four students less than the 805 used on the strategic financial spreadsheet.

Also, as noted in this article’s opening paragraph, the Year-Three spreadsheet figure for Net Tuition Income is $14,490,000, yielding an average net tuition figure (with 805 students) of $18,000. With your fresh projection of 801, you, as Business Manager, are in a strong position to recommend to your School Head and the Board’s Finance Committee the most prudent approach to “managing to Line 6,” the Hard Income P&L figure on the strategic financial spreadsheet. (The specific Hard Income P&L figure is not mentioned in this article, since that exact number has no bearing on this discussion.)

Your projected four-student shortfall, at $18,000 per student, yields $72,000 less on Line 2, the Net Tuition Income line. You can recommend addressing the difference by:

- raising the percent increase in listed tuition (i.e., raising the to-be-published tuition figure beyond the strategically planned increase) for Year Three;

- reducing the planned amount of tuition assistance (discounts in all categories of assistance) to be awarded;

- reducing planned operating expenditures (Line 6 of the spreadsheet) by $72,000; or,

- using some combination of the three, which yields $72,000.

Since the second-listed choice, reducing the amount of tuition assistance, would certainly affect the enrollment figure negatively, the first, third, or fourth choices usually prove to be prudent. And your choice will be determined by the particular variables you face at your school, e.g., will an increase of, say, one-half percent more than the strategically planned increase in the listed tuition figure depart dramatically from the levels of tuition increase in recent years; will a decrease of $72,000 in planned expenditures substantially reduce the enthusiasm among your constituents for the Year-Three enhancements called for in your strategic financial plan (such as added funding for professional development or the launch of a new cocurricular program)?

Each year and each situation call for differing recommendations on your part as Business Manager. But there are three responses to the projected four- student, $72,000 problem offered in the example that ISM recommends avoiding. You could:

- hope the situation corrects itself by the time school opens;

- ask the School Head to increase the annual fund goal by $72,000; or

- recommend drawing on your cash reserves to address the issue.

The problem with these options is that none of them “manages to Line 6” and, thus, none of them addresses the underlying problem, which is that enrollment has not reached the strategic financial plan’s 805 assumption in either Year One or Year Two, and, using the projection method advanced in this article, is not expected to do so in Year Three either. “Managing to Line 6”—the Hard Income P&L figure—means having the wisdom and courage to bring your Net Tuition Income (plus Other Hard Income) into line with your cash-based operating expenses. Until that is accomplished, your school will not operate on the cash-positive basis that allows it to:

- build cash reserves;

- reduce (or avoid) indebtedness;

- pay its employees well;

- provide appropriate employee benefits;

- fund employee professional development strongly; and

- move forward with exciting new programs and instructional methodologies.

Use this article’s approach to forecasting the upcoming year’s enrollment as a springboard to look closely at enrollment-related issues that may have been accumulating without having been forthrightly addressed. Sooner is better than later.